AI demands unprecedented power that traditional infrastructure can't deliver. The solution isn't just building more power plants; it's reimagining how we develop energy infrastructure from the ground up.

AI data center power consumption will surge 165% by 2030, requiring the equivalent of Japan's entire electrical grid

Geographic bottlenecks and grid constraints are creating critical infrastructure gaps that threaten AI development

Forward-thinking companies are pioneering "power-first" development models that co-locate renewable energy with data centers

Strategic infrastructure planning offers competitive advantages in speed-to-market and cost efficiency for AI companies

A single ChatGPT query consumes nearly 10 times more electricity than a standard Google search. Estimates are 2.9 watt-hours versus 0.3 watt-hours. Multiply that by billions of daily AI interactions, add the computational demands of training increasingly sophisticated models, and you arrive at an unprecedented energy challenge that's reshaping entire industries.

Global AI data center power consumption is projected to surge 165% by 2030, reaching 945 terawatt-hours annually. But the real crisis is the mismatch between how we've historically built energy infrastructure and what AI actually requires.

Why Can't Traditional Infrastructure Handle AI's Power Demands?

The existing power grid operates on 20th-century assumptions about industrial load patterns, including gradual growth, predictable demand cycles, and distributed consumption. AI infrastructure demand shatters these assumptions with concentrated, continuous, high-density requirements that overwhelm regional grid capacity.

Three critical bottlenecks are choking AI growth:

Geographic concentration creates power shortages: Northern Virginia, home to the world's largest concentration of data centers, now has vacancy rates below 1%, while regions like Dublin and Singapore have imposed moratoriums on new data center construction due to grid capacity constraints.

Transmission limitations block power delivery: Even regions with adequate generation capacity often lack the grid infrastructure to deliver power reliably to data centers. Utilities have historically over-forecast demand by more than 17%, leading to billions in stranded infrastructure investments.

Cooling demands compound energy consumption: AI workloads generate extreme heat that standard air cooling systems can't handle. Cooling accounts for up to 40% of a facility's total electricity consumption, effectively doubling the infrastructure challenge.

The energy drain AI data centers create is uniquely problematic because, unlike traditional industrial facilities that might operate in predictable cycles, AI workloads require continuous, high-density power around the clock.

How Are Companies Solving AI's Energy Infrastructure Challenge?

Rather than accept these constraints as inevitable, leading companies are pioneering different approaches through integrated "power-first" development models.

The breakthrough approach involves three key strategies:

Co-locate renewable energy with data centers: Google's recent partnership with Intersect Power and TPG Rise Climate illustrates this approach. Instead of building data centers and then searching for power sources, the partnership develops industrial parks where gigawatts of renewable energy generation and battery storage are co-located with data center capacity.

Integrated battery storage systems: These systems store excess energy during low-demand periods and release it during spikes, creating self-sustaining energy ecosystems that reduce dependency on fossil fuel backup generation. Battery storage is particularly effective for AI's unique power requirements, providing the instantaneous scaling that AI training demands.

Strategic land development: Companies are identifying and developing sites that simultaneously optimize for renewable energy generation and data center operations. This foresight eliminates transmission bottlenecks while providing direct access to clean, reliable power.

These integrated developments are already demonstrating advantages. Traditional data center development can take seven years from initial planning to full operation, while co-located facilities can substantially reduce this timeline. By eliminating the need for extensive transmission infrastructure, co-located facilities can also achieve higher renewable energy utilization rates.

What Competitive Advantages Do Smart Infrastructure Solutions Provide?

Forward-thinking approaches to AI data center power infrastructure offer advantages that surpass energy costs. Companies that secure dedicated, reliable power sources can accelerate their AI development cycles and avoid the geographic constraints that limit their competitors.

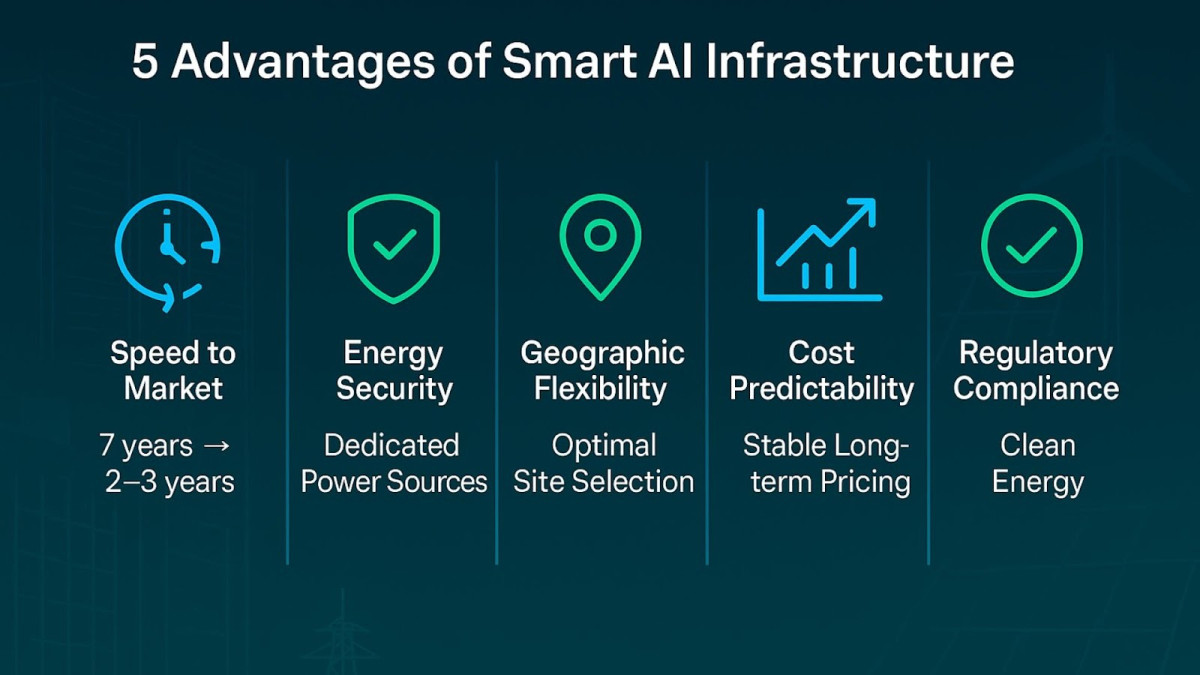

Five key competitive advantages emerge:

Speed to market: Time to power is the biggest consideration for data center operators when building new sites, making energy infrastructure a competitive differentiator.

Energy security: Companies with dedicated power sources aren't subject to utility rate increases, grid reliability issues, or capacity constraints that could limit their computational growth.

Geographic flexibility: Integrated infrastructure development enables companies to build in optimal locations rather than being constrained by existing grid capacity.

Cost predictability: Long-term renewable energy contracts provide stable pricing that shields companies from fossil fuel price volatility.

Regulatory compliance: As governments implement carbon accounting and renewable energy mandates, facilities with integrated clean energy infrastructure can more easily demonstrate compliance than those dependent on grid power with uncertain renewable content.

Proactive infrastructure planning provides the reliability and scalability that AI development requires, while reactive approaches to power procurement often result in delays and compromises that can set back AI initiatives by months or years.

Recent Investment Trends in Support of AI Energy Infrastructure

The financial markets are responding to these infrastructure innovations with unprecedented capital commitments, signaling a shift in how energy infrastructure gets developed and financed.

Investment flows are reaching historic scales:

Microsoft's commitment to 10.5 gigawatts of renewable energy delivery between 2026 and 2030 represents more generating capacity than many entire countries possess. Technology companies alone contracted over 50 gigawatts of clean energy in the first three quarters of 2024, with solar power dominating at 29 gigawatts of contracts.

Three major investment categories are attracting capital:

Renewable energy and storage: Integrated solar, wind, and battery storage projects specifically designed for data center co-location

Grid modernization: Advanced transmission technologies and smart grid infrastructure that can handle high-density AI loads

Specialized infrastructure development: Companies that focus on strategic land development and integrated energy solutions for AI applications

The scale and certainty of AI power demand are creating investment opportunities that can support much larger, more efficient infrastructure projects than traditional markets could sustain. Green bonds have become important financial instruments for enabling infrastructure development at scales that match the enormous capital requirements of modern AI systems.

How Are Policies and Technologies Coming Together to Enable Solutions?

The convergence of AI infrastructure demand with clean energy technology and supportive policy frameworks is creating opportunities for systemic infrastructure transformation.

Policy support is accelerating infrastructure development:

The Department of Energy's Transmission Facilitation Program is investing billions in grid modernization specifically designed to accommodate large-scale data center loads, while state-level policies are tying data center incentives to renewable energy commitments.

Federal support extends beyond renewables to include natural gas as a bridge fuel. FERC has expedited permitting for natural gas infrastructure Norton Rose Fulbright, while behind-the-meter natural gas agreements are enabling data centers to bypass grid bottlenecks entirely Data Center Dynamics.

With natural gas supplying over 40% of data center electricity Pew Research Center, the government recognizes its critical role in meeting immediate demand while renewable capacity scales up, particularly when paired with carbon capture and storage technologies.

Advanced technologies are multiplying grid capacity:

Advanced grid technologies are becoming available that enable more sophisticated approaches to managing AI power loads. Alternative transmission technologies, including dynamic line ratings and advanced power flow controls, can increase existing transmission capacity without requiring new construction.

AI is optimizing energy systems:

AI systems themselves are becoming tools for optimizing energy infrastructure, creating feedback loops that improve efficiency over time. Machine learning algorithms can predict renewable energy generation patterns, optimize battery storage dispatch, and manage cooling systems to minimize overall energy consumption.

This convergence is particularly evident in emerging policy frameworks that recognize data centers as potential grid assets rather than just consumers, enabling new business models where AI facilities provide grid services during periods of low computational demand.

Frequently Asked Questions

How much energy does AI actually use compared to other industries?

AI data centers currently account for about 1.5% of global electricity consumption, projected to reach nearly 3% by 2030. For perspective, this growth rate exceeds that of electric vehicles, manufacturing electrification, and most other emerging energy-intensive sectors combined.

Why can't we just build more power plants to meet AI demand?

The challenge isn't generation capacity but infrastructure mismatch. Traditional grid development assumes gradual, distributed load growth, while AI creates sudden, concentrated demand clusters. Transmission development can take seven to ten years versus data center builds of 18 to 24 months, creating an impossible timeline gap that forces companies to compete for limited existing grid connections.

What makes "power-first" development different from traditional approaches?

Traditional development builds data centers first, then negotiates for grid connections, often waiting years in interconnection queues. Power-first development reverses this: companies secure optimal land for renewable generation, build the energy infrastructure, then construct data centers directly adjacent. This eliminates transmission losses, utility dependencies, and interconnection delays while maximizing renewable energy capture rates.

Are these integrated infrastructure solutions actually cost-effective?

Yes, despite higher upfront capital costs, integrated solutions provide long-term cost advantages through predictable energy pricing, reduced transmission costs, and faster time-to-market. Companies with dedicated power sources also avoid utility rate volatility and grid capacity constraints that can limit growth.

How do these solutions help with climate goals?

Co-located renewable energy and data centers can achieve much higher clean energy utilization rates than grid-dependent facilities. They also enable AI companies to meet corporate sustainability commitments more reliably, since they control their entire energy supply chain rather than depending on grid power with uncertain renewable content.

What Does the Future Hold for AI Energy Infrastructure?

The AI energy challenge is an opportunity to rebuild energy infrastructure around the requirements of 21st-century technology rather than 20th-century assumptions about how power systems should operate.

Companies succeeding recognize infrastructure as a competitive differentiator rather than a commodity service. They're making strategic investments in integrated development models that provide energy security, cost advantages, and deployment speed that their competitors can't match.

This infrastructure innovation is particularly evident in companies like Hanwha Data Centers, which specializes in developing renewable energy infrastructure specifically designed for high-demand industrial applications like data centers. By focusing on strategic land development and integrated energy solutions, these companies are enabling the next generation of AI innovation through smarter infrastructure planning. Contact Hanwha Data Centers to learn more.